On the FY 2021 Tax Reform part. 2

February 20, 2021

~Expansion of housing loan deduction, comprehensive taxation for interest on corporate bonds issued by family-owned companies, and strengthening of taxation on short-term retirement allowances, etc.~

Introduction

Continuing from the previous article, this time we would like to focus on the items in the FY 2021 Tax Reform Proposal that have attracted much attention in the area of individual income taxation: the expansion of the housing loan deduction, the introduction of comprehensive taxation of interest on bonds issued by family-owned companies, and the strengthening of taxation on short-term retirement allowances.

Expansion of Housing Loan Deduction

The special measure for the housing loan deduction with a deduction period of 13 years, which was intended to counter the decline associated with the increase in the consumption tax rate to 10%, will be extended. After the extension, those who execute a new construction contract by the end of September 2021, or by the end of November 2021 for other construction contracts and move in by the end of December 2022 will be able to apply the 13-year exception (see the table below). In addition, for those who have a total income of 10 million yen or less, a house with a floor area of 40 to 50 sqm is eligible (previously, only houses with a floor area of 50 sqm or more was eligible) for the extension.

One of the items that will be carried over to the 2022 tax reform is the current “1% housing loan deduction from the year-end balance” system. In next year’s reform, the amount and rate of deduction will be reviewed; for example, the amount of deduction should be decided after considering the actual interest payment with 1% as the maximum. We can consider this as a response to the fact that the amount of mortgage deduction exceeds the amount of mortgage interest payment every year when the borrowing interest rate is lower than 1%, which is the mortgage deduction rate.

Expansion of Housing Loan Deduction

| Target | Acquisition of special exceptions (Acquisition, etc. of housing where the rate of consumption tax, etc., included in the pricing or expense is 10%) | |

|---|---|---|

| Classification | New construction of building for residential purposes | Acquisition of houses for sale and pre-owned homes, expansion and renovation, etc. |

| Contract Period | 2020/10/1~2021/9/30 | 2020/12/1~2021/11/30 |

| Residence Date | 2021/1/1~2022/12/31 | |

Comprehensive Taxation for Interest on Corporate Bonds Issued by Family-owned Companies, etc.

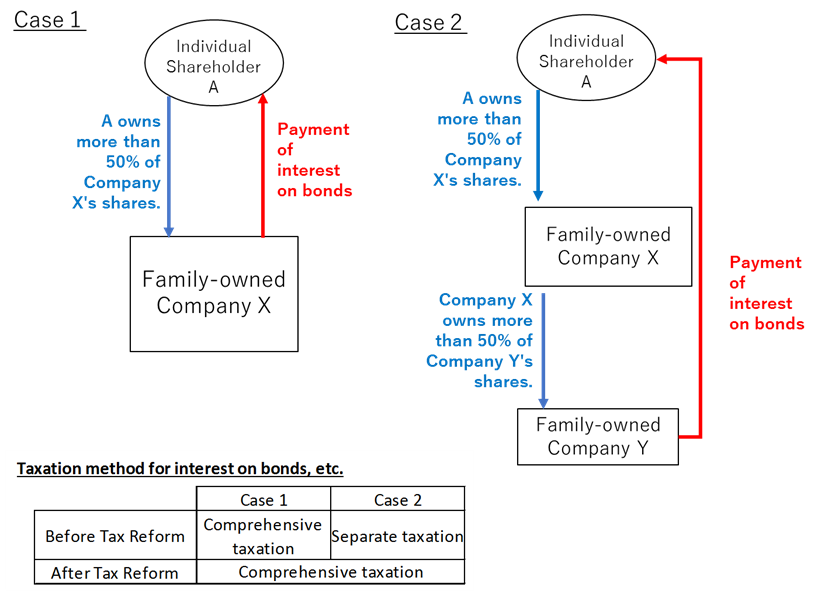

In principle, interest on corporate bonds is subject to separate withholding tax as interest income (income tax rate of 15.315% + local tax rate of 5% = 20.315%). However, interest on corporate bonds issued by a family-owned company that is paid by certain shareholders, such as the directors of the family-owned company, is subject to comprehensive taxation. This is a measure taken to prevent executives of family-owned companies from receiving remuneration in the form of interest on corporate bonds, which would normally be subject to a progressive tax rate (income tax rate ranges from 5 to 45%) under the comprehensive taxation system, from being subject to separate withholding taxation (20.315%), thereby reducing their tax burden.

With this, interest on corporate bonds paid by a family company’s subsidiary or sub-subsidiary was not subject to comprehensive taxation. With the tax reform, interest on corporate bonds paid by family shareholders through a corporation will also be subject to comprehensive taxation. In other words, if an individual, etc., or a relative of an individual, etc., who has a special relationship with the company issuing the bonds owns more than 50% of the outstanding shares, etc., of Company X, the interest on bonds received by the individual or relative through Company X will also be subject to comprehensive taxation even if the direct shareholder (which is the basis for determining whether a company is a family company) is Company X.

This will apply to interest and redemption of bonds to be paid on or after April 1, 2021. Please refer to the following image.

Strengthening of Taxation on Short-term Retirement Allowances, etc.

In the taxation of retirement allowance, the amount of income is defined as the amount after deduction of retirement allowance multiplied by one-half, in consideration of equalizing the tax burden, considering that retirement allowance is the result of long-term service and a part of the compensation for service is accumulated and paid at once. Since 2013, executives with less than 5 years of service have been exempted from the half computation on taxation on retirement allowance, but with this revision, employees (excluding executives) with less than 5 years of service are also exempted. We can consider this as measure taken to correct such tax-saving measures that do not fit the purpose of the aforementioned 1/2 taxation system. However, in consideration of the fluidity of employment, up to 3 million yen after deduction of retirement allowance will continue to be subject to 1/2 taxation. This will apply to income taxes for 2022 and thereafter.

Appropriate Taxation of Retirement Allowance (Summary)

| Years of Service | Less than 5 years | |||

|---|---|---|---|---|

| Retiree | Employee | Directors and Officers, etc. | ||

| Amount of income minus deduction for retirement allowance | Portion of amounts less than 3 million JPY | Portion in excess of 3 million JPY | — | |

| 1/2 Taxation | ||||

| Before Reform | Applicable | Applicable | Not Applicable | |

| After Reform | Applicable | Not Applicable | Not Applicable | |

Here, let’s review once again how retirement allowance is calculated.

※ The deduction for retirement allowance differs depending the length of the concerned employee’s years of service in the company.

| Years of Service (Y) | Deduction for Retirement Allowance |

|---|---|

| Less than 20 years | 400,000 JPY × Y (If the calculated amount is less than 800,000 JPY, it shall be 800,000 JPY) |

| More than 20 years | 8 million yen + 700,000 yen × (Y – 20 years) |

Any fraction of a year in years of service shall be rounded up.

Example: 10 years and 1 month → 11 years

Based on the above, the amount of retirement allowance paid to employees who will no longer be subject to the 1/2 taxation under this revision will be as follows:

If the concerned employee’s retirement allowance is more than 3 million yen after subtracting the retirement allowance deduction from the retirement allowance (amount of income), the 1/2 taxation calculation will not be applied, so its is possible to calculate the retirement allowance due amount by adding 3 million yen to the retirement allowance deduction.

Amount of short-term retirement allowance due to employees to which the 1/2 tax calculation will no longer apply

| Years of Service | 1 year | 2 year | 3 year | 4 year | 5 year |

|---|---|---|---|---|---|

| Amount of Retirement Allowance (amount of income) | Over 3.8 million JPY | Over 3.8 million JPY | Over 4.2 million JPY | Over 4.6 million JPY | Over 5 million JPY |

| Deduction for Retirement Allowance | 800,000 JPY | 800,000 JPY | 1.2 million JPY | 1.6 million JPY | 2 million JPY |

Conclusion

Together with our previous article, we covered items related to corporate taxation and individual income taxation included in the FY 2021 Tax Reform proposal. As response to structural changes in the economy and society, including the diversification of work styles, the Japanese government continues to exert effort in creating a fair individual income tax system that not favor or disadvantage any specific work style. It remains necessary to understand in detail the effects of these tax reforms, particularly the specific requirements and amounts relevant to each individual. We hope this series of articles will be of help.