Outsourcing Services (Accounting & Tax, HR & Labor, Payment Services)

RSM Shiodome Partners is a member firm of RSM International, an international accounting network with more than 64,000 members in over 820 offices in 120 countries around the world. In today’s rapidly changing economy, many companies are facing fierce competition like never before, and the need for adaptation is becoming increasingly important. In this environment, companies are not only focusing on reducing overhead costs but also collecting valuable information and segregating tasks that will help to generate additional value. Therefore, one of the topics that many managers are interested in is outsourcing internal operations.

As a member of an international accounting firm second only to the Big 4, we at RSM Shiodome Partners take advantage of our position to be able to provide one-stop, speedy, and comprehensive support for your company’s administrative division by utilizing our certified professionals with extensive knowledge such as our certified public accountants, tax accountants, and labor and social security attorneys.

【Table Of Contents】

- Outsourcing Services Provided

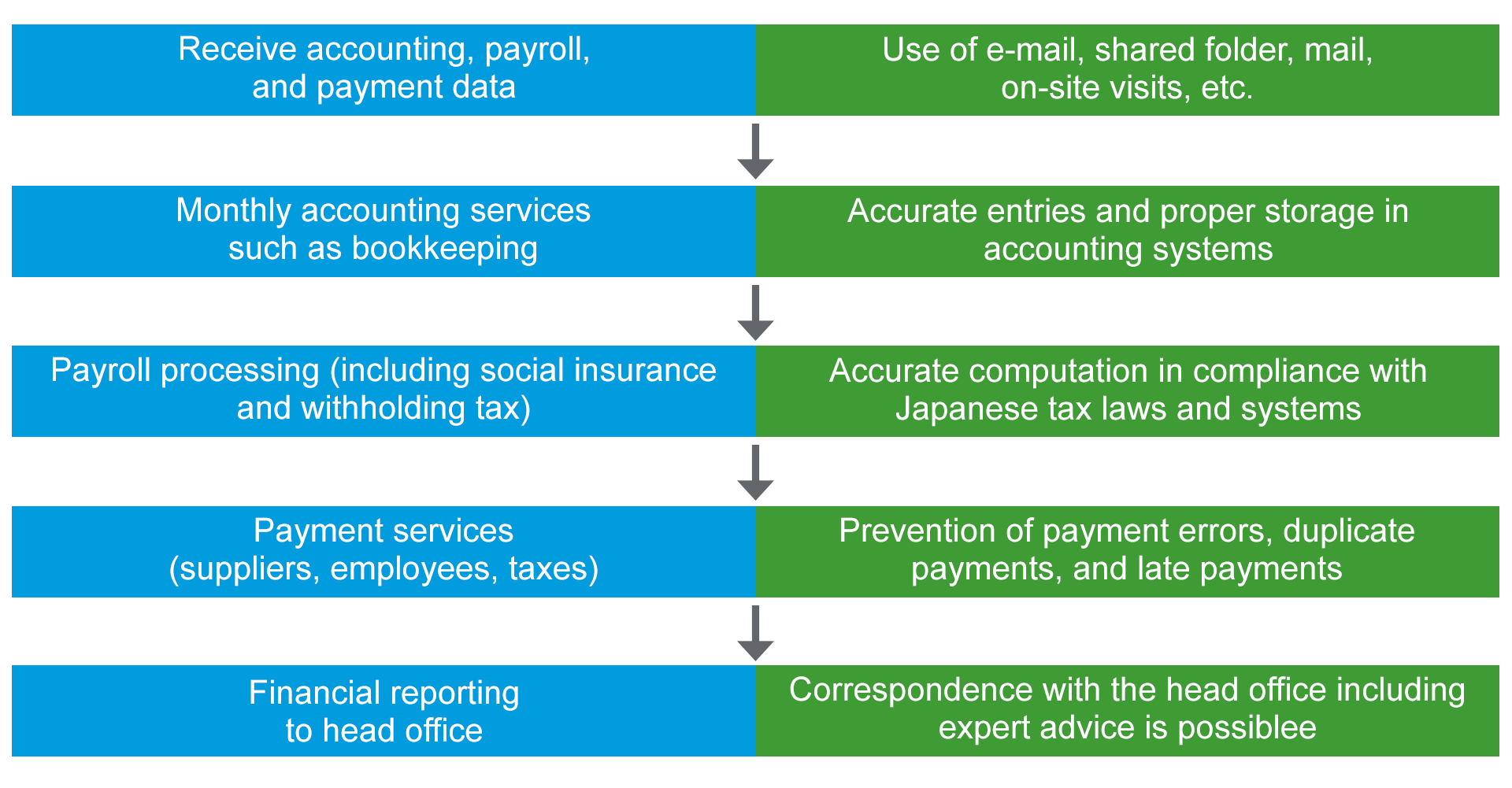

- Outsourcing Flow

- Features of Outsourcing Services

- Benefits of Outsourcing

- Accounting Outsourcing

- Outsourcing Payroll and Social Insurance Procedures

- Payment Outsourcing

- Accounting and Labor Departments After Outsourcing

- How Much Does Outsourcing Reduce Costs?

1. Outsourcing Services Provided

“One-Stop Service”

Unlike other countries, Japan has a unique way of classifying when it comes to segregating various qualifications. Outsourcing services such as bookkeeping, payment, billing, social insurance, employment regulations, internal rule-making, payroll calculation, etc., are all segmented. Thus when a company outsources, they will usually need to undergo a contract for each qualified person individually, which imposes a wide range of constraints in terms of cost, time, and human resources.

At RSM Shiodome Partners, we have many experienced professionals in different fields, including certified public accountants, tax accountants, labor and social security attorneys, administrative scriveners, and judicial scriveners. As a result, we can handle almost any outsourcing that a company can request and can provide effective and efficient one-stop services to maximize our clients’ corporate value.

Our consistency is not only limited to the scope of work, but also we are capable of adapting. We can also provide services in multiple languages, with qualified staff members who can utilize English, Chinese, and other languages at a native level.

“Flexibility and Quality”

RSM Shiodome Partners has a proven track record of undertaking work for a wide variety of clients since its inception. As a result, we are capable of handling a diverse range of clients with no limit to the scale of the company. We can work with clients ranging from medium-sized companies to publicly listed companies, and across a wide range of industries and sectors.

We customize the system/software used by the company, the reporting format, and the form of business implementation (face-to-face or through cloud services) and provide services in a manner that is tailored to the client.

In terms of quality, as a member of RSM International, we adhere to the high standards of the international network and have established a system of multiple staff members under the supervision of in-house, nationally certified professionals to ensure that quality is maintained. By utilizing uniformly established internal processing procedures within RSM Shiodome Partners, we are able to provide high-quality, cost-effective, and stable outsourcing services for back-office operations.

3. Features of Outsourcing Services

One-stop service

・We provide services through the collaboration of a wide range of professionals:

・Certified public accountants, tax accountants, labor and social security attorneys, administrative scriveners, judicial scriveners, etc.

・No need to consult with multiple firms, saving time and costs.

Quality

・Our team members have a wide range of qualifications and skills.

・We have established a unified internal processing procedure to maintain quality.

・We maintain quality by establishing a system of checks by multiple staff members.

Customized Service

・We use software and systems tailored to your company’s needs.

・We can create reports in a format tailored to your company’s needs.

・On-site or cloud-based services

・Multilingual (English, Chinese, etc.) services

Flexibility

・We serve a wide range of clients, from medium-sized to publicly listed companies, in a variety of industries and sizes.

4. Benefits of Outsourcing

Risk Management

It is extremely important to comply with the various tax systems and regulations when doing business in Japan. However, it is difficult for companies with limited resources to do this on their own. By outsourcing accounting, payroll, and other processes to RSM Shiodome Partners, you can ensure you meet compliance requirements and minimize risk.

High-Quality

Japan has numerous national licenses and qualifications for various types of work, and enlisting the help of these licensed experts is essential for improving the overall quality. You can be assured of high-quality services by outsourcing accounting, payroll, and other services to RSM Shiodome Partners.

Reduce Costs

Outsourcing accounting, payroll, and payment services can greatly reduce labor, tax, and benefit costs. With Japan’s workforce significantly decreasing, hiring and training the right people can be very costly and can be time-consuming.

Saves Time

By having professionals handle accounting, payroll, and other processes in a timely manner, the administrative department can focus on other value-added tasks that are difficult to outsource.

Customizable

RSM Shiodome Partners has accumulated considerable expertise in the day-to-day processing of accounting and payroll. We are capable of providing the best solutions to our clients’ various requests in terms of software, languages, reporting methods, etc., enabling stress-free outsourcing of work.

5. Accounting Outsourcing

When doing business in Japan, it is necessary to prepare financial statements to pay taxes in Japan and to report to stakeholders. However, there are differences between accounting standards (JGAAP, USGAAP, IFRS, etc.) and tax standards, so it is necessary to hire accounting personnel who are familiar with these differences to prepare accounting books and perform closing tasks. If the company is a foreign-affiliated company, English language skills are also required. In recent years, it has become very difficult to hire excellent accounting personnel internally due to the shift in career development for accountants. In many cases, it has also become increasingly difficult to hire a bookkeeper in-house due to the inability to secure appropriate personnel. If bookkeeping can be outsourced, managers can then focus on running their business instead of having to worry about recruiting/ training. Outsourcing not only bookkeeping operations but also upstream processes can further improve operational efficiency.

For example, the following operations can be combined:

・Payment operations (cash and bank transfers)

・Invoicing

・Payroll calculation

・Social insurance administration

Since these operations are ultimately connected to bookkeeping operations, outsourcing these and other operations can produce even higher quality and more efficient results.

6. Outsourcing Payroll and Social Insurance Procedures

Many human resource managers have trouble understanding how to do payroll calculations in Japan, as well as income tax calculations, unemployment insurance rates, and social insurance premiums. One of the biggest dilemmas that persist in many companies is hiring someone who can perform payroll calculations, but then they leave the company on a short term. It is not an easy task to hire new employees with equal or comparable skills. Japan is facing a labor shortage, and this has been increasingly noticeable in areas of skilled personnel, but this is especially true with qualified HR. Payroll is a task that always occurs monthly in any company and in any given industry, but the following problems, including those mentioned above, have become a real issue in recent years:

(1) Turnover rate is high among those in charge of payroll

(2) Unsure if payroll is being calculated properly

(3) Want to reduce the cost of hiring HR employees for payroll

(4) For confidentiality reasons, you do not disclose highly sensitive salary information to staff members who do your payroll (but do not have the time to do it yourself)

(5) The time and effort required for payroll interferes with core business plans

(6) Lacking in updating information about new changes in the law

(7) Unfamiliar with insurance premium rates

By outsourcing your payroll calculation to RSM Shiodome Partners, you can solve all of the above problems and enjoy the following benefits:

(1) Reduction of payroll personnel costs

(2) Avoid disruption of operations due to the high turnover rate of payroll staff, etc.

(3) Ensure that payroll calculations align with changes in the law (social insurance premium rates are revised annually)

(4) Prevent personal information (salary info) from being leaked within the company

7. Payment Outsourcing

Payment operations are mainly divided into “transfers” and “over-the-counter payments,” but they are important and nerve-wracking operations as this operation carries risks in handling the company’s cash funds. Entrusting company funds to employees can come with various risks.

As a general rule, it is dangerous for a single person to handle company funds, so at least two people should double-check with each other. Even small companies need to build internal controls. However, this comes at a corresponding cost.

By outsourcing the costly payment operations, employees can focus on other key functions, which will aid in developing company growth.

8. Accounting and Labor Departments After Outsourcing

Many companies these days outsource accounting, payroll, social insurance procedures, and other tasks. At RSM Shiodome Partners, various specialists work closely together to provide one-stop, high-quality outsourcing services. Outsourcing with RSM Shiodome Partners will bring the following benefits to accounting and labor departments:

(1) Leads to business improvement

By outsourcing bookkeeping and payroll calculation work, it is possible to clarify and organize the workflow of the company so that work can be performed effectively and efficiently, leading to work improvement.

(2) On-time submission

Even during the holiday season or with employee leave, you can ensure sufficient human resources externally, allowing a stable monthly submission of deliverables. In addition, you don’t have to worry about teammates leaving, and you can greatly reduce the effort of training new members.

(3) Close collaboration with experts

With a professional firm that can be consulted immediately, you can always receive expert advice.

(4) Minimize internal access to sensitive information

In-house accounting and HR operations require multiple staff members to access highly sensitive payroll and personal information. Restricting members who have access to this information through outsourcing brings peace of mind to department managers and personnel alike.

(5) You can shift to future-oriented work

Bookkeeping and payroll work are tasks that face past figures, but by outsourcing these tasks, members of the accounting and labor departments can shift to more value-added, future-oriented work. For example, you can focus on areas that are difficult to outsource, such as business plan formulation, budget performance analysis, and personnel evaluation systems.

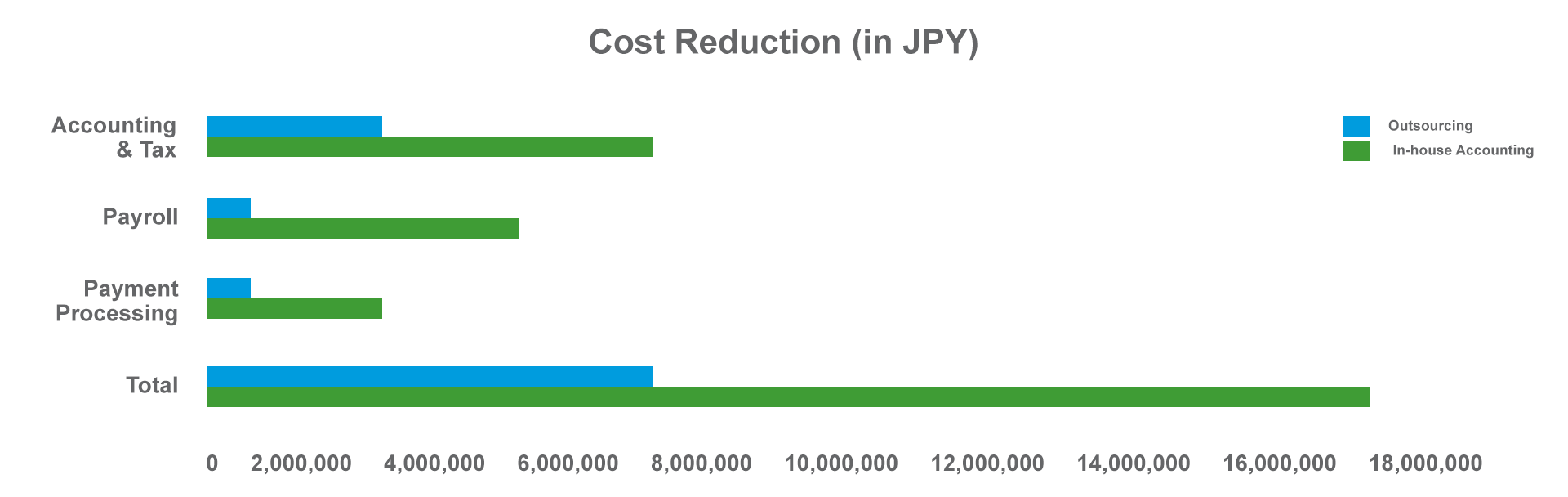

9. How Much Does Outsourcing Reduce Costs?

One of the most important benefits of outsourcing is the possibility of cost reduction. Let us introduce a case in which a client used outsourcing services for a package of accounting, tax, payroll, social insurance procedures, and payment services based on a case in which we assisted a foreign company that had expanded into Japan.

The business was a Japanese subsidiary of an IT company headquartered in Germany and was established by the president of the Japanese subsidiary, a sales manager, and several sales representatives.

The administrative department needed to hire an accounting and tax manager and a human resources manager fluent in English. They will need a salary of at least 6 million yen and 8 million yen per year, respectively (even this amount may be difficult as salaries are projected to increase). In addition, a staff member in charge of payment administration (starting at 4 million yen per year) must be hired for said work. The total cost for personnel alone is projected at roughly 18 million yen per year.

On the other hand, the fees we provided for accounting and taxation services, payroll and social insurance processing services, and payment services were 4 million yen, 2 million yen, and 2 million yen per year in conjunction, for a total cost of 8 million yen (consumption tax not included).

Although this is a simple calculation, this client is getting a monetary cost reduction benefit of about 10 million yen per year. This client is very satisfied with the low cost and stable service.

The above-mentioned employee salary did not include company-paid social insurance, benefits, computers, office supplies (desks, chairs, etc.), or recruiting costs, so the client is actually receiving more than this amount in monetary benefits.

RSM Shiodome Partners’ outsourcing service provides cost-effective, high-quality, and stable back-office outsourcing services under the supervision of in-house, nationally certified professionals.

The role of the CFO is not to finalize past accounting books but to make accurate decisions on future projections. We provide high-quality services at reasonable prices to support management decision-making. Please feel free to contact us for more information.