Updates to the National Tax Agency’s COVID-19 FAQs in Japan

November 20, 2020

~The GoTo Campaign and Deduction of Medical Expenses~

Introduction

On October 23, 2020, the National Tax Agency provided an update to its “FAQs about the tax treatments for the tax filing and tax payment procedures, etc. relating to the prevention of the spread of COVID-19”.

The update mainly provided clarification on the tax treatment regarding the following three items:

| 1 | Handling of benefits from the Go To Travel Campaign |

|---|---|

| 2 | Deductibility of medical expenses for purchase of masks, PCR tests, and other expenses related to online medical services |

| 3 | Taxation of salaries for remote work rendered overseas |

We will cover the changes made to the said FAQ (1 updated question and 7 additional questions) in two installments.

For this first column, we will look at:

① Handling of benefits from the Go To Travel Campaign; and

② Deductibility of medical expenses for purchase of masks, PCR tests, and other expenses related to online medical services.

Handling of benefits from the Go To Travel Campaign

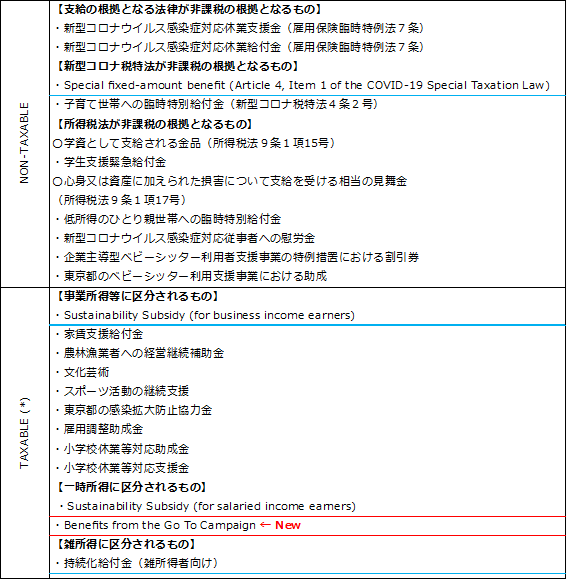

In question number 9 of the FAQs, regarding the “tax treatment of subsidies provided to individuals by the national government or local governments”, the subsidies provided by the government (both national and local) to individuals due to the effects of COVID-19 such as the benefits provided under the Go To campaign (such as “Go To Eat” and “Go To Travel”) are now classified as “temporary income”.

In Q9, specific examples for cases involving the “tax treatment of major subsidies provided by the government, etc. in relation to the effects of COVID-19” are provided as follows.

Here, it is also clearly stated that the “Special Cash Payment”, which provided 100,000 Japanese yen to all citizens, is exempt from taxation, while the “Sustainability Subsidy” is subject to income tax.

In addition, “temporary income” (which the benefits from the Go To campaign that are categorized as) refers to income other than that obtained from continuous profit-making activities, meaning such income that does not have “the nature of compensation for labor or services” or “the nature of compensation for the transfer of assets.”

In other words, this applies to income that is not compensation for labor or sale of assets and cannot be received continuously. Examples of temporary income and the calculation method are as follows:

Examples of Temporary Income (excluding those received in connection with business or continuously received)

① Prizes from sweepstakes and lotteries

② Refunds from horse races and bicycle races

③ Lump-sum payments from life insurance, maturity refunds of non-life insurance, etc.

④ Money and goods donated by corporations

⑤ Reward money, etc. received by a person who finds lost property or buried treasure

Computing Temporary Income:

Total amount of income ― amount spent to earn the income ― special deduction (up to 500,000 yen) = Amount of temporary income

One important point is that as long as the total amount of the temporary income earned in a year (including temporary income from sources other than the Go To Campaign) does not exceed 500,000 Japanese yen, it is offset by a deduction of up to 500,000 yen and no tax return would need to be filed.

As such, it would be unlikely that the benefit from the Go To Campaign alone would exceed 500,000 Japanese yen. However, if an individual were to receive a large amount of money as a lump-sum income in the same year (for example, refund following the maturity of an life insurance policy) and this causes the total annual temporary income to exceed 500,000 Japanese yen, then they will need to file a tax return that including a declaration of the benefit received via the Go To Campaign.

Deductibility of medical expenses for purchase of masks, PCR tests, and other expenses related to online medical services

The following three questions related to the deduction of medical expenses have been added.

Question 12. Can the medical expense deduction be applied to the purchase of masks?

Question 12-2. Can the medical expense deduction be applied to PCR testing expenses?

Question 12-3. Can the medical expense deduction be applied to expenses for online medical services?

(1) Items qualified for the deduction for medical expenses

As a prerequisite, medical expenses that can be qualified are as follows:

① Expenses incurred in medical care and treatment done by medical practitioners, doctors, etc.; and

② Expenses incurred in the purchase of medical supplies necessary for treatment and recovery.

Therefore, whether or not a certain expense is eligible for the deduction of medical expenses is determined from the perspective of whether or not it meets any of the requirements above.

(2) As a response to each question, let’s see what changes had been made.

Question 12. Can the medical expense deduction be applied to the purchase of masks?

The purchase of masks is for the prevention of infection and does not fall under the category of “expenses paid for medical treatment or care done by medical practitioners, etc.” nor does it fall under the category of “medical supplies” and therefore cannot be deducted as a medical expense.

Question 12-2. Can the medical expense deduction be applied to PCR testing expenses?

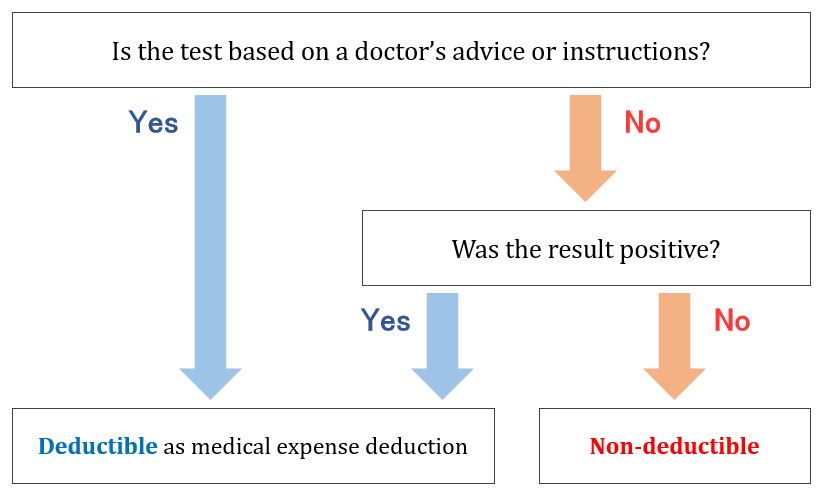

The cost of the PCR test will be determined by dividing it into the following two cases.

① The cost of PCR testing at the discretion of a medical practitioner, etc. is deductible as a medical expense (limited to the portion of the cost shouldered by the patient).

② The cost of a PCR test taken at one’s own discretion to confirm that one is not infected is more difficult to determine. If the result of the PCR test is “positive” and the patient continues to receive treatment, the cost of the test is deductible as a medical expense because the test is considered to be the same as a medical examination prior to treatment. On the other hand, if the PCR test result is “negative”, the cost is not deductible for medical expenses.

To better visualize, you may refer to the figure below.

As described above, the key points for applying the deduction for PCR test expenses are whether or not it was based on the judgment of a medical practitioner, etc., and whether or not treatment was given after the PCR test returned a positive result.

Question 12-3. Can the medical expense deduction be applied to expenses for online medical services?

Expenses related to online medical treatment*, which was introduced to prevent the spread of COVID-19, will be classified into the following categories: (1) online medical treatment fees, (2) online system usage fees, (3) purchase cost of prescribed medicines, and (4) delivery cost of prescribed medicines, and the application of deduction for medical expenses will be determined for each expense.

*“Online medical treatment” refers to a treatment system that allows patients to receive treatment from a doctor while at home and have prescription information sent to a pharmacy of their choice, which can then deliver the prescribed medication to their home.

(1) Deductions for medical expenses ➡ ①②③

(Rationale) For items ①②,③ it would be considered expenses paid for medical care and treatment by doctors, etc.

(2) Items that do not qualify for the medical expense deduction ➡ ④

(Rationale) Item ④ does not necessarily fall under either expenses paid for medical care or treatment by doctors, etc., or expenses for the purchase of medicines necessary for treatment or recovery.

Conclusion

In this issue, we took a look at the items related to the deduction of benefits from the Go To Campaign and medical expenses in the updated part of the “FAQs about the tax treatments for the tax filing and tax payment procedures, etc. relating to the prevention of the spread of COVID-19”.

We recommend that those who have received subsidies from the government or other organizations, related to the effects of COVID-19, including the Go To Campaign, or those who have made payments to medical institutions for expenses related to COVID-19, check the contents of the FAQ once again.

In the next article, we would like to look at the taxation on salaries for remote work across countries due to the restrictions on overseas travel caused by the COVID-19.