Reduced Consumption Tax Rates and the Point Reward Project for Cashless Payments in Japan

November 20, 2019

Introduction

It has been quite some time already since Japan increased its consumption tax rates to 10% starting October 1, 2019. Together with the increase in tax rates is the introduction of the “Reduced Consumption Tax System” and the “Point Reward Project for Cashless Payments”. With these two new schemes, consumer’s purchasing patterns can vary, starting from where they purchase (does the establishment offer point rewards for cashless transactions?), what they purchase (what is the consumption tax rate levied on the purchased item?), to how they pay for their purchases (should one pay in cash or use the cashless method and earn points?). In this article, we will talk about how these two schemes can help consumers by reducing the additional tax burden.

Reduced Consumption Tax Rate System

The reduced consumption tax rate system aims to reduce the tax burden of low-income earners by applying a reduced consumption tax rate of 8% (rather than 10%) on certain daily necessities such as “food and beverages (excluding alcoholic beverages) and food ordered to-go” as well as “newspapers that are published at least twice a week based on existing subscriptions”. (for more information, you may read Advisory Column dated 2018.07.20 https://www.uchida-it.co.jp/column/20180720/ [Japanese]).

Point Reward Project for Cashless Payments

The point reward project for cashless payments aims to level the demand against the consumption tax hike and promote cashless transactions. The project, which will run for 9 months starting October 1, 2019 until June 30, 2020, will involve registered stores which offer its customers the option to use cashless payment methods when paying for their purchases. With the cashless payment method, customers can earn points up to 5%, or avail of discounts.

① Target Stores

Only small-to-medium establishments (not larger enterprises) can register for the point rebate system. Furthermore, SMEs under a franchise chain can receive a 2% return under this system. The Ministry of Economy, Trade and Industry (METI) will distribute posters and stickers with the Cashless logo to stores who have registered under this system so that they can be easily recognized by consumers.

② Cashless Payment Methods

Methods of cashless payments include credit card, debit card, electronic money, prepaid cards, QR codes, and mobile payments. However, it depends on the store what kinds of cashless payment methods they accept, as well as a limit on how much points they can issue.

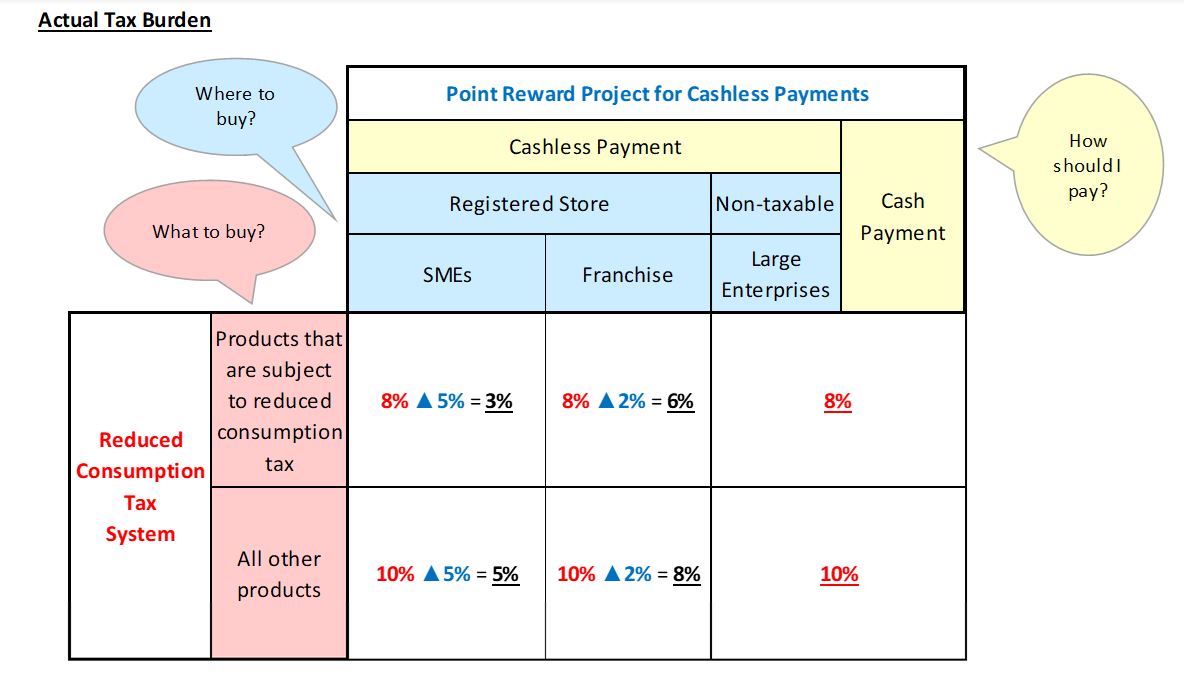

Actual tax rate shouldered

Now that the above two tax-reducing systems exist, how much is the actual tax burden of consumers? We’ve tried to summarize this below.

As you can see above, using cashless payment methods can greatly reduce the consumption tax burden shouldered by consumers, depending on what and where they buy.

Conclusion

The consumption tax hike that went into effect on October 1, 2019 was accompanied by the introduction of the Reduced Consumption Tax Rate scheme and the Point Reward Project for Cashless Payments, both aiming to reduce the tax burden on consumers. However, with these two new schemes, it may be difficult for consumers to actually understand how much this could benefit them. Looking at the two new schemes in this article, we tried to find out how much tax burden is lifted from end-users. While the Point Reward Project for Cashless Payments will only be in-effect until the end of June 2020, using cashless payment methods with this scheme in effect has shown a significant decrease in consumption tax. We hope this article has been useful in helping you decide whether to switch from cash to cashless payments, or simply in understanding the new schemes.

![Tax Relations of Consumption Tax in the First Year of Establishment of a Japanese Corporation [Text] Consumption Tax on a picture frame beside plant](https://shiodome.co.jp/en/wp-content/uploads/2020/02/shutterstock_561284410-300x300.jpg)