Why you should outsource your Accounting, Payroll, and Payment Operations in Japan

July 26, 2022

Many business owners tend to do all the work during the start-up phase. However, management time is very limited so instead of spending their time for all the business processes, it is best for owners to ask a specialist for the back-office operations. As a back-office specialist, we want to help you and your business succeed by focusing on what you do best and support you as you devote yourself in that area. To do this, we advise our clients to outsource their accounting, payroll, and payment operations. Outsourcing back-office operations has many benefits and we would like to introduce the reasons in this article.

【Table Of Contents】

- What is outsourcing?

- The 5 benefits of outsourcing

- Benefits of outsourcing your accounting operations

- Benefits of outsourcing your payroll services

- Benefits of outsourcing your payment procedures

- Benefits from a cost reduction perspective

- Benefits from a risk management perspective

- Benefits for the finance and labor departments

- Features of Shiodome Partners’ outsourcing service

1.What is outsourcing?

Outsourcing refers to requesting external companies or individuals to perform non-core business duties related to the core business of the company. In outsourcing, a comparison is usually made to decide whether to hire employees internally or to hire an external company or individual.

Occasionally, people confuse outsourcing with offshoring, but these are completely different concepts. Offshoring involves establishing your own subsidiary in a country with low wages and performing accounting and payroll operations there. Thus, you have to build and manage everything on your own. Outsourcing, on the other hand, subcontracts certain services required by the company to external companies and individuals, eliminating the need to build and operate the organization itself.

2. The 5 benefits of outsourcing

Cost reduction

Outsourcing accounting, payroll, and payment operations can significantly reduce personnel costs, taxes, and welfare costs associated with these activities. In recent years, the working population has declined significantly in Japan, and the cost of recruiting and training the right people has become very costly.

Risk management

It is extremely important to follow various tax systems and regulations when doing business in Japan. Most companies with limited resources may find it difficult to do this on their own. By outsourcing accounting and payroll processing to a company with specialists, you can ensure compliance and minimize risk.

High quality

In Japan, there are various national qualifications related to various businesses, and it is essential to use the skills of licensed professionals such as certified public accountants, tax accountants, and social insurance attorneys to be assured of a high quality standard. By outsourcing accounting and payroll services to a company that has these specialists, you can certainly receive high-quality services.

Time saving

With professionals performing timely accounting and payroll tasks, administrative employees can free up time for other tasks. Management then would be able focus on high value-added work that forms part of the core business that cannot be commissioned.

Customized services

A company that handles accounting, payroll services and related operations daily has the considerable know-how. As a result, it is possible to provide the best solution for various client requests in terms of software, language, reporting system, reporting method, etc., so that the business operation can be outsourced without stress.

The benefits of outsourcing, as well as concrete examples, will be explained further below.

・Benefits of outsourcing your accounting operations

・Benefits of outsourcing your payroll services

・Benefits of outsourcing your payment procedures

・Benefits from a cost reduction perspective

・Benefits from a risk management perspective

・Benefits for the finance and labor departments

I will introduce the above with some examples.

3.Benefits of outsourcing your accounting operations

When conducting business in Japan, it is essential to prepare financial statements both for tax payment in Japan and to your company’s stakeholders. However, the different accounting standards (JGAAP, USGAAP, IFRS, etc.) have different accounting and taxation treatments. Thus, it is necessary to hire an accountant who is familiar with these differences to prepare the accounting books and perform accounting operations as needed.

If you can outsource the bookkeeping operations, your company’s members can devote their time to concentrate on the core business. This would greatly benefit the company. In addition, by outsourcing not only bookkeeping operations but also upstream processes, further efficiency and cost reduction can be achieved.

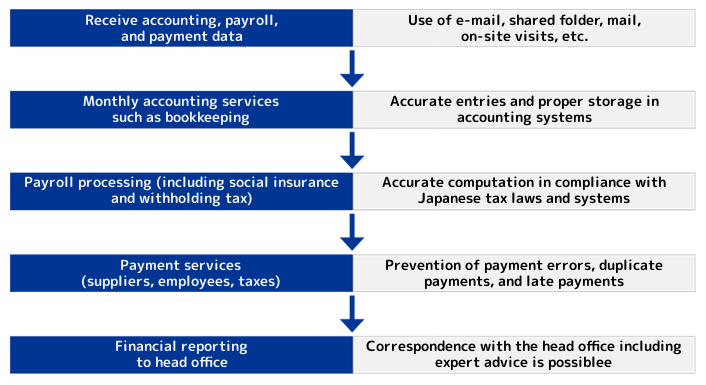

You can obtain greater benefits by outsourcing the following tasks:

・Payment duties (cash / bank transfer)

・Invoice preparation

・Payroll processing

・Social insurance processing

Since these operations will ultimately lead to bookkeeping operations, availing outsourcing services including these operations can produce more effective and efficient results.

4.Benefits of outsourcing your payroll services

The following are the benefits of outsourcing your payroll services:

(1) Reduce labor costs related to payroll processing

(2) Avoid disruption of business due to payroll staff’s retirement, absence, etc.

(3) Calculate payroll in compliance with changes in the statutory laws (social insurance rates are revised annually).

(4) Prevent personal information (salary amount) from leaking into the company

Regardless of industry, payroll processing is a business task that occurs every month. However, the payroll process generally involves the following issues, including the items already mentioned above.

(1) High turnover rate of staff in charge of payroll

(2) Uncertainty in the accuracy of payroll computation

(3) Aim of reducing the cost of hiring HR employees for payroll

(4) For confidentiality purposes, owners don’t want their own employees to calculate the payroll (however owners don’t have time to do it themselves)

(5) Time is used for payroll processing instead of using it to deal with the core business of the company

(6) Lack of information on revised statutory laws related to payroll

(7) Insufficient understanding on the social insurance rates

Considering these factors, it is advisable to outsource the payroll process to professionals, including the paperwork for social insurance.

5.Benefits of outsourcing your payment procedures

Payment operations is one of the most sensitive processes of a company and should be done error-free. The payment processing is mainly divided into two methods, “bank transfer” and “over the counter payment”, but because either method involves the movement of cash, extreme care should be exercised when handling the payments.

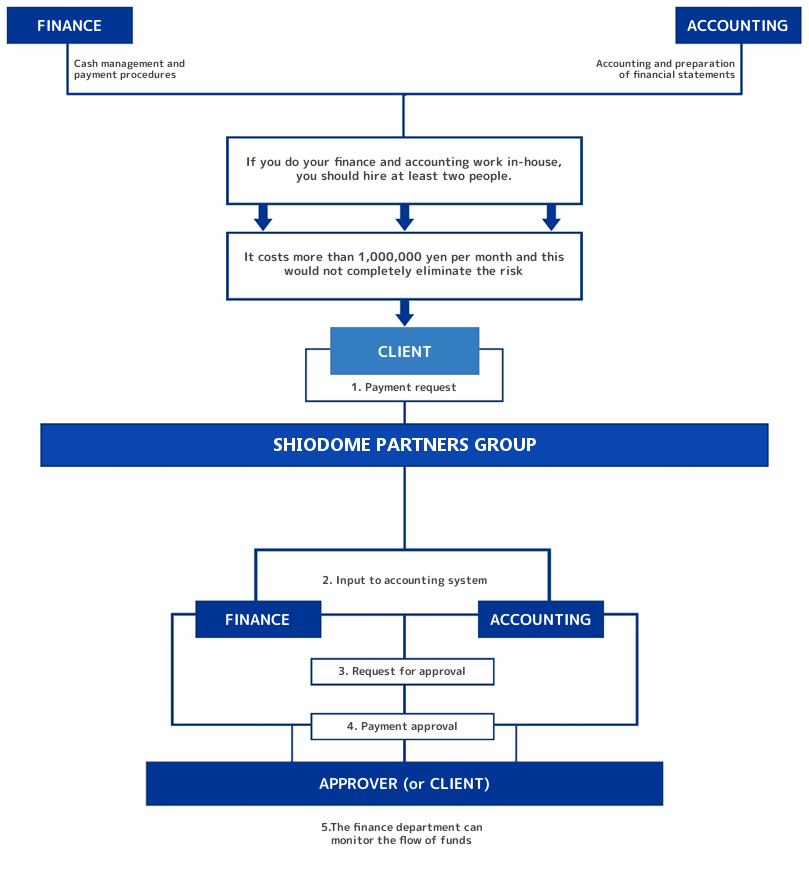

In principle, it is quite risky to just employ one person to handle all the funds. Thus, it is necessary to have a minimum of two or more people to cross-check the payment details with each other. It is also important to establish internal control, even for a small corporation. In order to accomplish this, a company must spend a reasonable cost.

Outsourcing the payment operations can be a great benefit because members can concentrate more on their core business instead of carrying out the payment duties.

6.Benefits from a cost reduction perspective

One of the important benefits of outsourcing is that it can reduce costs. We will present in the succeeding topics how cost can be reduced when clients use outsourcing service packages for accounting tax, payroll, social insurance procedures, and payment process.

(1) Process flowchart and key points of the outsourcing service

(2)How much cost can be saved?

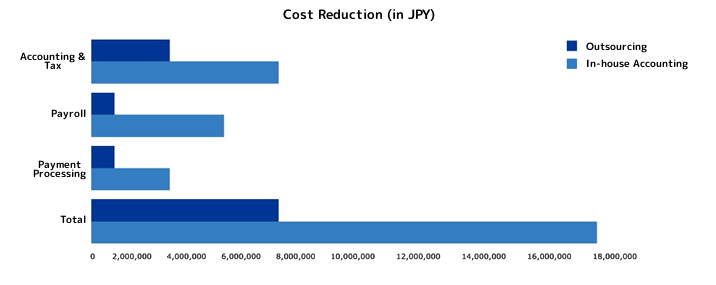

To answer the question above, we will present an actual case wherein we supported a foreign-affiliated company in Japan.

Our client is a new business comprised of its president, a sales manager and a few sales representatives.

According to their management department, hiring an English-speaking accounting and tax manager and a human resources and labor manager will require a minimum annual income of 8,000,000 yen and 6,000,000 yen respectively (the amounts are already considered as conservative estimates in today’s labor market). In addition, it is necessary to hire a staff member in charge of the payment operations (with an estimated annual salary of 4,000,000 yen). The total cost if they established such department is estimated at 18,000,000 yen.

On the other hand, the professional fees for the accounting and tax services, payroll and social insurance procedures services, and payment processing services we provided were 4,000,000 yen, 2,000,000 yen, and 2,000,000 yen respectively, with a total of 8,000,000 yen (excluding consumption tax).

Thus, the company was able to get a cost savings of around 10 million yen per year.

7.Benefits from a risk management perspective

As mentioned above, in addition to cost reduction, availing outsourcing services also has benefits from the point of view of risk management.

By using our BPO service, Shiodome Partners appoints multiple persons and provides services separately to finance and accounting staff. There can also be a separate approver, and a senior manager who will check the books and payment details (working alongside the client).

One of the benefits of the outsourcing service is that it is possible to build internal controls through triple checks between the duties in separate divisions. The summary below are the benefits of outsourcing from a risk management perspective:

(1) Reduction of the following effects:

Turn-over of employees

Leakage of confidential information

Adjusting of duties between busy and off-peak periods

(2) Prevention of the following:

Preparation of inaccurate financial statements

Suspicious transaction

Occurrence of delinquent tax and additional penalty tax

Violation of law

Data loss

(3) The following can be assured:

Advice from experts who are more well-informed than your hired employees when it comes to legal compliance.

8.Benefits for the finance and labor departments

Recently, more and more companies are outsourcing their accounting, payroll and social insurance procedures. In addition to the benefits listed above, there are also benefits specifically for the finance and labor departments.

(1) Leads to business improvement

By outsourcing bookkeeping and payroll work to an external company, management would be able to analyze and organize the workflow of the company. This would lead to improvement of activities to perform the work effectively and efficiently.

(2) Can submit reliable deliverables

With enough external manpower available even during the Christmas season and sudden employee holidays, it is always possible to submit stable deliverables to the management. In addition, you will not have to worry about the retirement or resignation of your teammates, and you will be able to significantly reduce the training costs of new members. Thus, you will be able to stay calm and focus on your important tasks.

(3) Work closely with the experts

With a professional firm that can be consulted right away, you can get advice from a professional at any time. In addition, our professionals provide advice which are highly beneficial to your business. This will certainly be a relief for the members of your company.

(4) Minimize internal access to sensitive information

In-house accounting and human resources operations require multiple staff members to access highly sensitive information about salaries and personal information. Restricting the members who can access this information through outsourcing provides peace of mind to department managers and staff.

(5) Shift to future-oriented tasks

Bookkeeping and payroll operations are jobs that deal with historical numbers and outsourcing these operations allows members of the accounting and labor departments to shift to more value-added, future-oriented tasks. For example, internal employees can focus on areas which are difficult to outsource, such as formulating business plans, budget performance analysis, and personnel evaluation systems.

9.Features of Shiodome Partners’ outsourcing service

Customizable service

・Use of software system that fits for your company

・Preparation of reports in a format that suits your company

・Provide services either by directly visiting your company or by using cloud services

・Services are available in multiple languages (English, Chinese, Korean, etc.)

One stop service

・Services by a wide range of experts:

– Certified public accountant, tax accountant, administrative scrivener, social insurance attorney, lawyer, etc.

– Save time and costs without having to consult multiple offices.

Quality

・Members with various qualifications and skills will respond to clients’ needs

・We have created unified in-house processing procedures to maintain the quality of our service.

・We have established a review system with multiple personnel to control the quality of our work.

Flexibility

・We serve clients from a wide range of industries and business structures, from private businesses to listed companies.