Tax Relief Measures Part of Emergency Economic Measures in Response to COVID-19 in Japan~Exceptions to the Tax Payment Deferral System・Refund from Carryback of Losses・Tax System for Capital Investments made by SMEs for Teleworking, etc.~

April 20, 2020

Introduction

In response to the spread of COVID-19, the Japanese Cabinet approved emergency economic stimulus measures amounting to 117.1 trillion JPY (48.4 trillion JPY in fiscal expenditure), as well as “Taxation Measures Part of the Emergency Economic Measures to Cope with COVID-19”. These support measures, as well as the related bills were enacted, promulgated, and put into effect on April 30. These tax measures include 12 items, such as a special tax deferral system, a special exception for tax refunds by carrying back losses, and a tax system for small and medium-sized enterprises (SMEs) who have made capital investments for telework, etc.

We will be discussing the taxation of these measures, which affect many companies and individuals, in two parts.

Specific details of the tax measures in the Emergency Economic Measures to Cope with COVID-19

Among the 12 tax measures under the Japanese government’s Emergency Economic Measures to Cope with COVID-19, we will discuss the first five. In this issue, we are going to discuss the following:

① Exceptions to the tax payment deferral system;

② Refund from the carryback of losses;

③ Tax system for capital investments made by SMEs for teleworking, etc.;

④ Application of income tax exemption applied to donations for those who have waived their right to claim a refund of admission fees, etc. for cancelled events, etc.; and

⑤ Relaxing the requirements for mortgage deductions.

① Exceptions to the tax payment deferral system

The payment of national and local taxes and social insurance premiums of taxpayers whose income has decreased considerably due to the effects of COVID-19 will be postponed for one year without collateral and delinquent taxes. Those who are eligible for this measure and the taxes that are subject to it are as follows:

Those that meet either of the following:

| Affected Taxpayers | ① If revenues within a certain period (more than one month) from February 2020 onwards declined (by more than 20%) compared to the same period last year ② If one-time payment of tax/dues is difficult |

|---|---|

| Affected Taxes, etc. | Basically all taxes (except stamp taxes paid on stamps) and social insurance premiums, including corporation tax, consumption tax, and property tax, are due from February 1, 2020, to January 31, 2021. However, retroactive application is possible for those taxes that are due before the effective date. |

Comparison with the Current Tax Payment Deferral System

| Current System | Exception |

|---|---|

| ● Deferral of tax payment when a large deficit occurs during a certain period of time (one year in principle). ● As a general rule, collateral must be provided. ● Delinquent taxes are reduced (1.6% annually). | ● The tax payment is deferred for one year if the revenue decreases * during a specified period (more than one month) from February 2020 to the payment deadline. *More than 20% compared to the same period last year. ● No collateral needed. ● Exemption from delinquent taxes. |

Reference: Taxation Measures part of the Emergency Economic Measures to Cope with COVID-19 (related to Economy, Trade and Industry) (Ministry of Economy, Trade and Industry)

https://www.kanto.meti.go.jp/kansensho/data/200407_coronavirus_hosei_zeisei.pdf

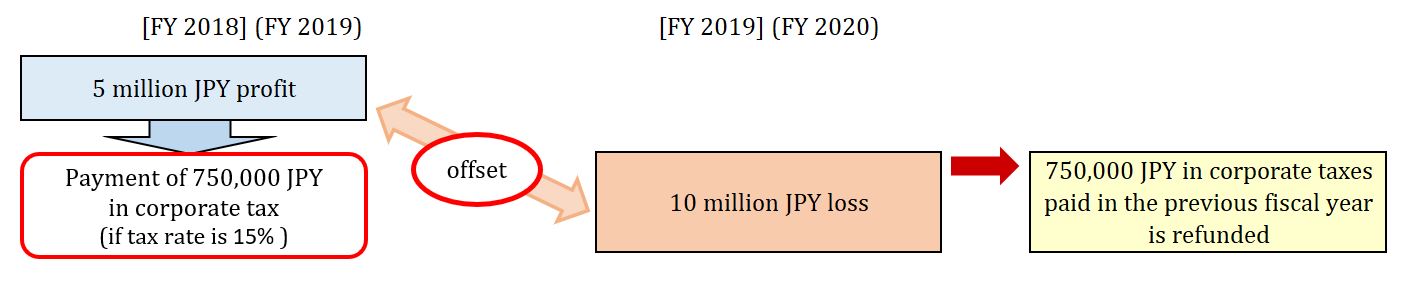

② Refund from the carryback of losses

The scope of the tax loss carryback program has been expanded to allow companies to receive a partial refund of corporate taxes paid in the previous year. The following is an overview of the refund from the carryback of losses:

Special Provisions for Refund by Carrying Back Losses

| Affected Corporations | (Current System) SMEs with a capital of less than 100 million JP ⇩ (Exception) Expanded to include corporations with capital of 1 billion JPY or less *Excluding wholly-owned subsidiaries of large corporations (e.g., corporations with more than 1 billion JPY in capital) and corporations in which all of the issued and outstanding shares are held by more than one large corporation within a wholly-owned group. |

|---|---|

| Losses Included | Losses incurred in fiscal years ending between February 1, 2020 and January 31, 2022 *Disaster losses incurred due to the effects of COVID-19 may be eligible for a corporation tax refund. |

< Outline of Provisions for Refund by Carrying Back Losses >

Reference: Taxation Measures part of the Emergency Economic Measures to Cope with COVID-19 (related to Economy, Trade and Industry) (Ministry of Economy, Trade and Industry)

https://www.kanto.meti.go.jp/kansensho/data/200407_coronavirus_hosei_zeisei.pdf

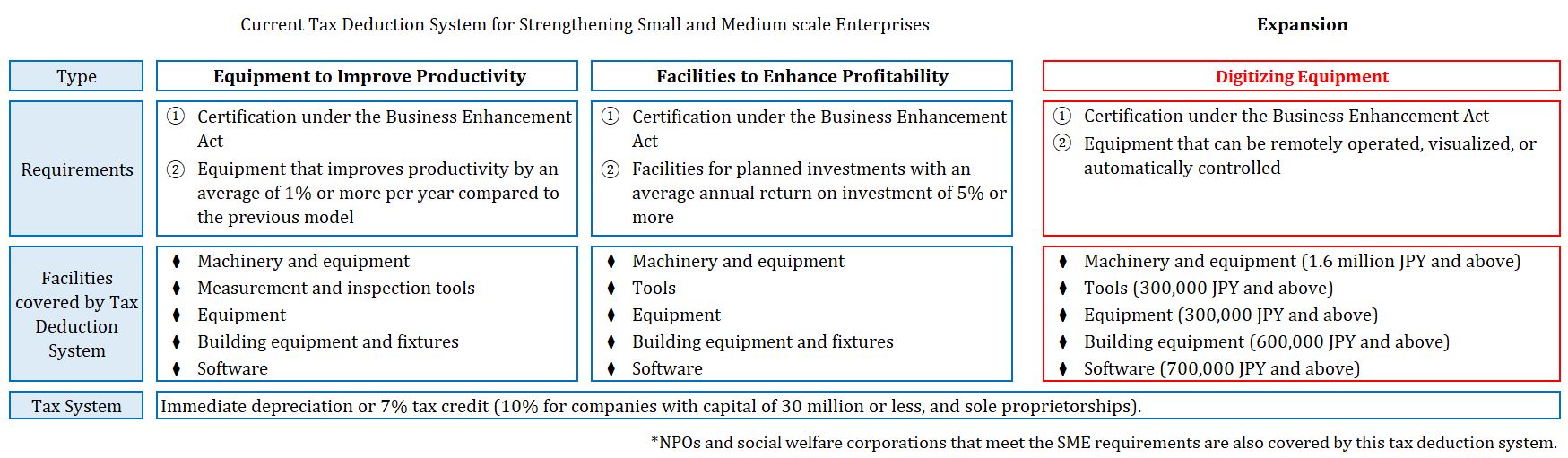

③ Tax system for capital investments made by SMEs for teleworking, etc.

A new type of tax credit will be added to the system of tax deductions for strengthening small and medium-scale enterprises to promote non-face-to-face and non-contact activities, as a response to social issues that have emerged as a result of the spread of COVID-19. In other words, an immediate depreciation or a 7% tax credit (10% for companies with capital of 30 million yen or less) is allowed for capital investment that enables either (1) telecommand, (2) visualization, or (3) automatic control of business processes.

Reference: Taxation Measures part of the Emergency Economic Measures to Cope with COVID-19 (related to Economy, Trade and Industry) (Ministry of Economy, Trade and Industry)

https://www.kanto.meti.go.jp/kansensho/data/200407_coronavirus_hosei_zeisei.pdf

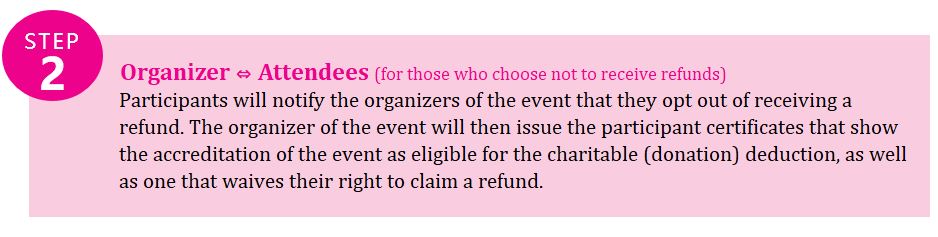

④ Application of income tax exemption applied to donations for those who have waived their right to claim a refund of admission fees, etc. for cancelled events, etc.

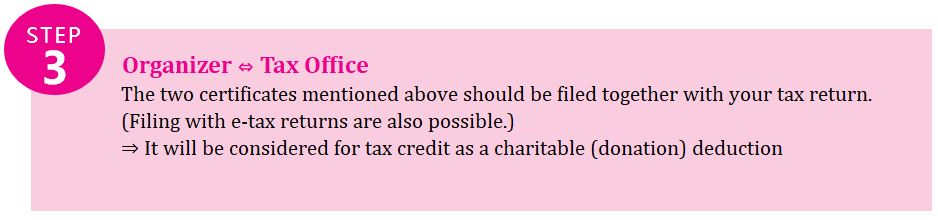

If an attendee does not request a refund of admission fees, etc. to an organizer who has cancelled a certain cultural, artistic or sporting event following the government’s request for voluntary quarantine, the amount of money waived (up to 200,000 yen) can be subject to a tax deduction for income tax purposes.

| Included Events | Events that were scheduled to be held in Japan between February 1, 2020, and January 31, 2021 that had been cancelled, etc. |

|---|

Flow of Donation Deductions

Source: Agency of Cultural Affairs

https://www.bunka.go.jp/koho_hodo_oshirase/sonota_oshirase/pdf/2020020601_05.pdf

⑤ Relaxing the requirements for mortgage deductions

- Special measures for the 13-year mortgage tax credit period (*1) will be applied even if occupancy is delayed due to the effects of the COVID-19 (until end of December 2020), as long as certain requirements are met.*1 – The tax credit is available to those have acquired or will acquire a home at 10% consumption tax rate, and move in by the end of December 2020. Currently, the tax credit period is set at 10 years if one will move-in in 2021.

Fixed Requirements

① Moving in (occupancy) was delayed due to the effects of COVID-19 ② The contract must have been finalized by a certain date:

a.) For new custom-built homes: end of September 2020

b.) For the acquisition of condominiums and existing houses, or additions and alterations to existing houses: end of November 2020③ Must move in (occupy) by the end of December 2021 - The mortgage tax credit for the mortgage tax reduction for the acquisition of an existing house (within 6 months from the date of acquisition) can be applied if certain requirements are met, even if occupancy is delayed due to the effects of COVID-19 on additions and alterations made after acquisition.

Fixed Requirements

① Moving in (occupancy) was delayed due to the effects of COVID-19 ② The contract must have been finalized by a certain date:

a.) Up to 5 months after the date of acquisition of the existing home

b.) Up to 2 months after the date of enactment of the relevant tax act③ Occupancy must be within 6 months from the date of completion of the extension, etc.

Conclusion

In this article, have explained 5 of the tax measures under the Emergency Economic Measures to Cope with COVID-19 individually. With all the information available, please take the time to review the information you find necessary, as well as continue to pay attention to the daily changes in the situation and present information. Our next article will discuss the remaining items.