Accounting and Tax Services in Japan

Efficient & Cost Effective Solutions For International Businesses

Streamlining accounting, tax, and related financial operations poses a significant challenge for foreign companies engaged in business activities in Japan, primarily due to the intricate and diverse accounting and tax regulatory landscape.

At RSM Shiodome Partners, we take pride in our team of seasoned professionals, including Certified Public Accountants (CPAs) and Certified Public Tax Accountants (CPTAs), who bring extensive international experience to the table. We offer an extensive array of corporate accounting and tax services and operate as an extension of our clients’ organizations, delivering comprehensive solutions to their unique challenges.

With our well-established reputation and wealth of experience, you can trust in our expertise to ensure compliance and enhance operational efficiency.

Comprehensive Business Accounting & Bookkeeping

Our skilled accountants are proficient in utilizing major accounting software applications such as Yayoi and Money Forward Cloud Accounting System. We can seamlessly adapt our services to align with your existing default software and Enterprise Resource Planning (ERP) systems, including Quickbooks, Xero, Sage, Dynamics 365, SAP, and NetSuite. This flexibility allows you to focus on your core business operations with complete peace of mind. Our comprehensive suite of services encompasses:

Monthly, quarterly, and annual accounting reports & tax procedures

—We ensure the timely preparation of company accounting ledgers, reports, analyses, and income tax settlements, all in strict adherence to Japanese tax and accounting regulations.

Bilingual financial statements and reporting

—We have the capability to create accounting documents, including balance sheets and financial statements, in both English and Japanese, along with any requisite explanatory correspondence to clarify the content and purpose of these reports.

Management of fixed assets

—Even well-established companies often find the complexities of Japanese regulations governing fixed asset classification and management to be challenging. Our proficiency and extensive experience enable us to provide you with a seamless and hassle-free solution.

Tax consultations

—With our assistance, you can save on tax payments, mitigate tax liabilities, while ensuring full compliance with tax regulations.

Year-end corporate income tax return preparation and filing

—We are equipped to prepare and submit your company’s annual income tax return, aligning it with Japanese regulations, International Financial Reporting Standards (IFRS), or U.S. Generally Accepted Accounting Principles (GAAP), as needed.

Compliance to international accounting standards

—Precise accounting solutions for companies following IFRS or U.S. GAAP

Consumption tax return preparation and filing

—You may be required to file a consumption tax return, depending on the type of business you manage (e.g., export, duty-free retail store). Our tax professionals navigate Japan’s tax regulations efficiently and cost-effectively, shielding your company from costly mistakes.

Not just tax and accounting, we offer BPO services for Cash Management, Payroll, Social Insurance, and Corporate Legal Affairs.

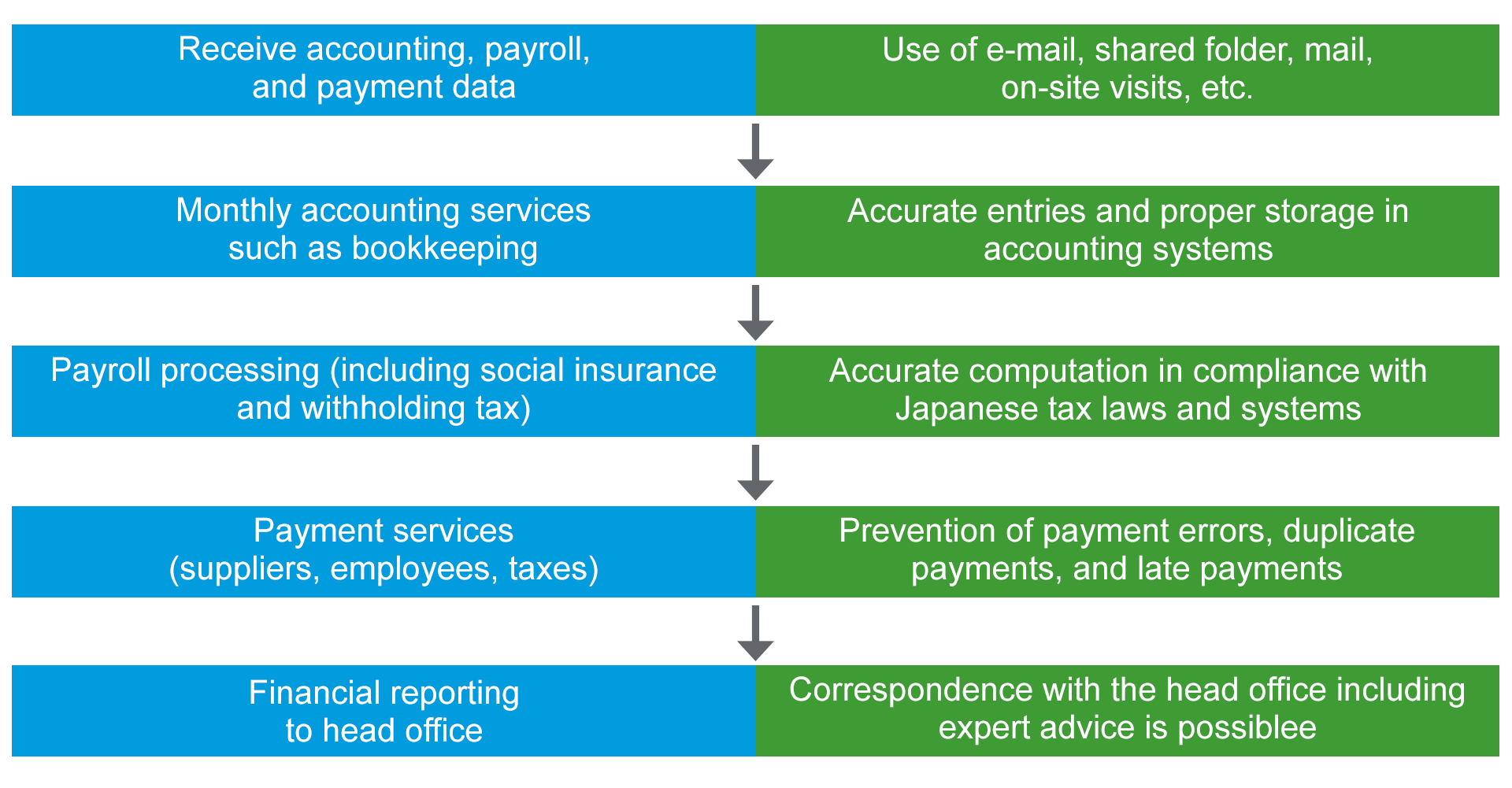

Below is an example of our outsourcing flow and key points:

The advantages of our outsourcing services are not limited to quality alone. Our outsourcing services can also be an effective means of resolving labor shortages and reducing costs.

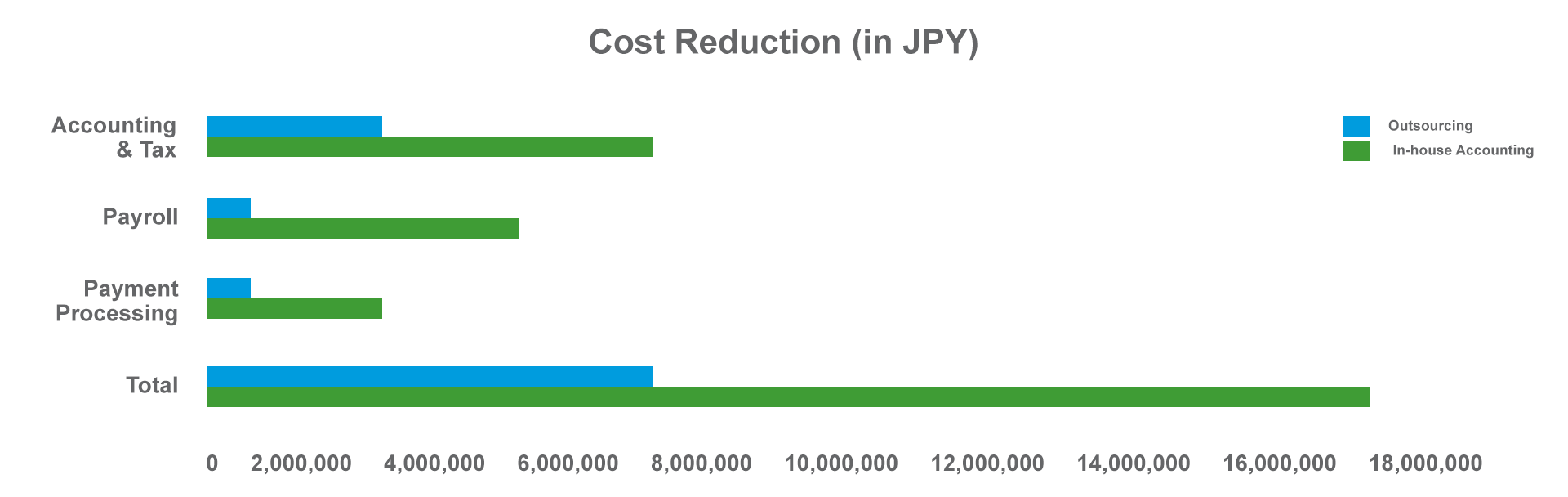

Below is an example of how much a client can save by using our services as a package for accounting, tax, payroll, social insurance, and payment services.

It is a case of a Japanese subsidiary of an IT company headquartered in Germany. The annual cost was estimated to be at least 18 million JPY if the company hired accounting and payroll professionals as direct employment. By using our outsourcing services, it could reduce the corresponding annual costs to 8 million JPY. (Please refer to the link for details Outsourcing Services (Accounting & Tax, HR & Labor, Payment Services) | RSM Shiodome Partners)

In addition, these services are performed under strict internal controls by professionals with years of experience in accounting, taxation, payroll, and payment services. Hence, the quality of these services is higher than if they were performed in-house with minimum headcounts.

Outsourcing allows you to allocate your limited workforce to tasks that require higher priority.

At RSM Shiodome Partners, we recognize the distinctive challenges that international corporations encounter when operating in Japan. As a Japanese representative of RSM International, which is ranked as the 6th largest global network of independent accounting firms, our international clientele can rely on our team of CPAs and Certified Tax Accountants to effectively navigate Japan’s intricate legal and business environment to their benefit.

Our professional accounting services offer numerous advantages, including:

- Reduction of overhead costs and elimination of the need for an in-house accountant.

- Assurance of full compliance with Japan’s accounting and tax laws and regulations.

- Accurate financial record keeping and analysis

- A dedicated team of accounting experts who prioritize the unique needs and best interests of our clients.

We are confident that we can be your best partner for your Japanese back-office operations, especially in the area of accounting and tax. We will provide one-stop support for the success of your business.

Contact UsAccounting and Tax Services – Fee Structure

Regarding the fee structure for our Accounting and Tax Services, we will provide a quotation either on a time charge basis or a fixed fee arrangement calculated from the estimated hours to be spent on the expected scope of work. Depending on the matters to be consulted, there may be cases where it would be difficult to apply the fixed fee arrangement. Nevertheless, RSM Shiodome Partners takes on the mission to provide excellent cost-effective services within the budget of the client. Please feel free to contact our consultants for the details of our fee structure.