Business Succession during COVID-19 in Japan

August 20, 2020

Introduction

While companies whose business environment has been negatively impacted by the COVID-19 often opt to take advantage of loans and subsidies, there is a growing trend, particularly among small and medium-sized companies, that address the difficulties they face through business succession.

Even before the impact of COVID-19, small and medium-sized enterprises (SMEs), which account for more than 99 percent of all enterprises in Japan and serve as a pillar of the Japanese economy and employment, were already facing problems such as aging owners and a lack of successors. Considering the circumstances, business succession has been recognized as an important issue for maintaining and developing the Japanese economy, as evidenced by measures to support smooth business succession.

One of the reasons for the rise in business succession cases due to the COVID-19 is that small and medium-sized companies whose business conditions were not favorable had already been considering either closing down their businesses, transferring, or handing-over their businesses. The deterioration of the business environment due to the COVID-19 simply accelerated the timing of their decision. The fall of share prices due to the COVID-19, as well as an increasing number of successors and buyers, result in companies taking advantage of this unique opportunity to reduce the cost of share succession, which is an important factor in business succession.

In this article, we would like to focus on the second reason and how business succession of small and medium-sized enterprises (SMEs) is done considering the effects of COVID-19, particularly the valuation of unlisted shares from “succession of shares”.

Business Succession and Succession of Company Shares

Business succession refers to the transfer of matters related to a company’s business, including management rights, management resources (management philosophy, technical know-how, human networks, etc.), assets (treasury stock, funds), and liabilities, to a successor.

Among the assets to be transferred are the company’s treasury stock, which supports the management of the company. In the case of owner-operator companies (companies where the owner also runs the day-to-day operations of the company) particularly, the treasury stock is a foundation that stabilizes management, and the transfer of the company’s treasury stock (succession of company shares) is an extremely important factor in business succession.

Stock Valuation: Key Point for Succession of Company Shares

One of the biggest challenges when it comes to the succession of company shares is the reduction of the financial burden caused by business succession. Taking over a company’s shares at a time when stock prices are rising requires a huge amount of capital, which can be pulled from retained earnings, although this can have a negative impact on the business after the succession.

Minimizing the financial burden of the transfer of company shares is important in order to ensure the successful operation of the business after succession. The cost of succession depends on the appraised value of the shares to be transferred; the lower the value of the shares, the lower the cost. But first, let us understand how company shares are valued in the first place.

What is Stock Valuation?

Both listed and unlisted stocks are valued using the following formula:

Stock Value = Value per share (2) x Number of shares (1)

(1) Number of shares

The number of shares can be easily understood from a balance certificate or the register of shareholders.

(2) Value per share

In the case of listed stocks, the value per share (stock price) can be easily ascertained because there is a market price traded daily on the stock exchange.

On the other hand, since there is no market price for the shares of unlisted companies, which most small and medium-sized companies fall under, the value per share is determined by considering various factors such as the purpose of holding the shares (influence on management), the company’s industry, size, performance, and net assets.

As you can see, the key to the stock valuation is the “valuation per share”. Next, let’s look at the valuation method for unlisted stocks. The valuation method for unlisted stocks would essentially be “determining the value per share for unlisted stocks”.

Valuation Method for Unlisted Stocks

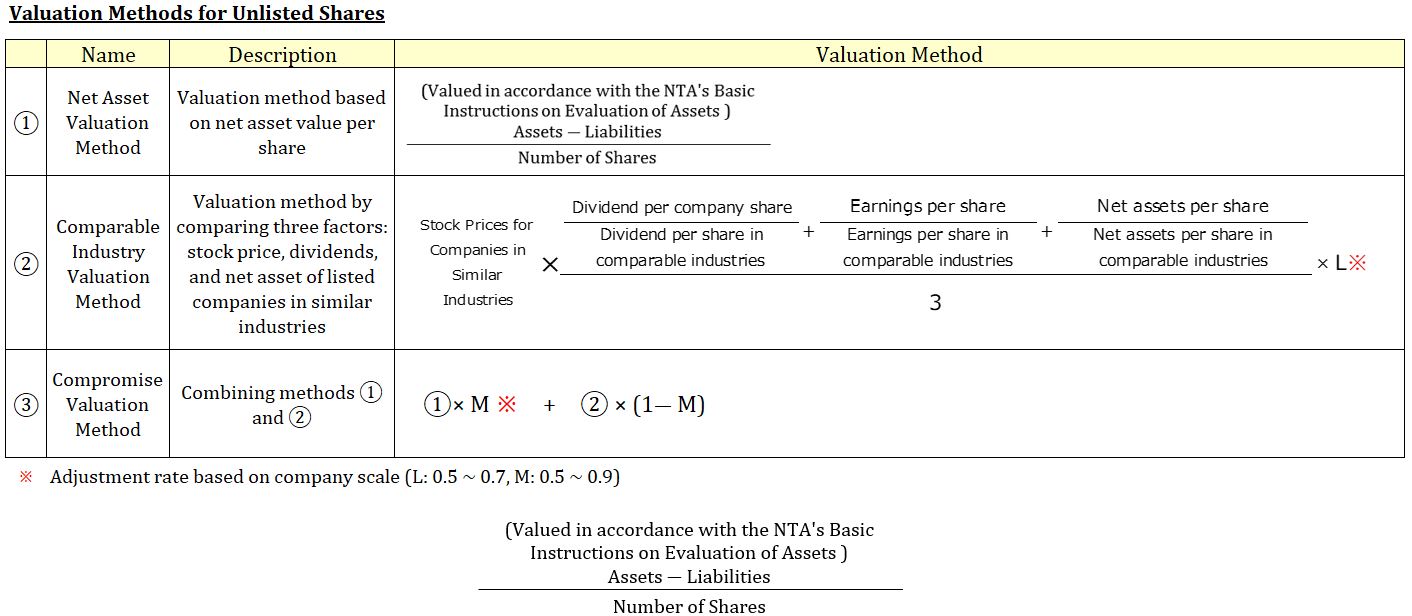

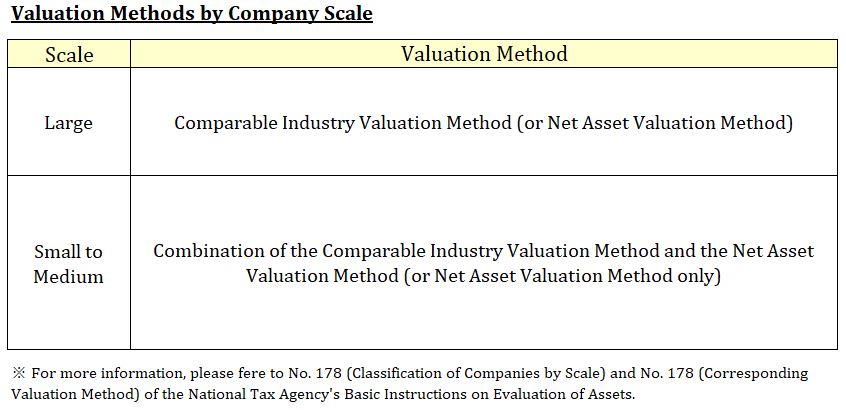

There are three methods of valuing unlisted shares when transferring shares.

In addition, depending on the size of the company, the appropriate valuation method varies.shares.

In general, the net asset valuation method tends to result in a higher valuation of stocks than the comparable industry valuation method.

Regardless of the valuation method used, a decline in stock price or deterioration in business performance during a recession is a factor that can lower the valuation of stocks.

Conclusion

In this article, we focused on the issue of the succession of company shares, which is one of the factors that contributed to the increase in business succession cases during the COVID-19 pandemic. With the effects brought about by the COVID-19 pandemic, such as falling stock prices, it is a prime time to do business succession thanks to the reduced costs. This in turn can be beneficial for the businesses concerned.

However, it is important to remember that the transfer of shares is only one part of the whole business succession process, and that the essence of business succession lies in the succession of the management itself. As the task of managing the business is passed on, it is important to take into consideration “invisible assets” such as the training of successors.

In order to ensure the success of business succession, it is necessary to consider not only the costs involved, but also the various perspectives from an expert’s perspective, and to take careful, well-planned measures.