Outline of the FY 2020 Tax Reform in Japan

January 20, 2020

Introduction

On December 12, 2019, the Outline of the FY 2020 (Reiwa 2) Tax Reform was released. Included in the Outline are tax reforms that come from different perspectives. Reforms with the goal of realizing sustainable economic growth in mind include measures on open-innovation activities, measures to encourage investments and wage increases, revisions to the consolidated taxation system, and measures to promote 5G-related equipment installations. Reforms for adapting to economic and social structural changes are tax measures for unmarried single-parents and review of tax deductions for widows/widowers, and a review of the NISA program. Other reforms included are reviews of the international tax system, addressing the issue of property tax on land with unknown owners, improving tax payment environment, etc.

From among these wide range of tax reforms, we will discuss here the review of the NISA system, as it concerns individuals.

Outline of the (current) NISA program

NISA, which stands for “Nippon Individual Savings Account”, is a tax exemption program in which profits from financial products such as stocks and mutual funds are exempt from tax, modeled after the United Kingdom’s Individual Savings Account.

Generally, income tax (20.315%) is levied on profit upon sale and dividends gained from investments in financial products such as stocks or mutual funds. For example, if an individual obtains a gross profit of 100,000 JPY through investments, an income tax of around 20,000 JPY will be deducted, meaning the net earnings will only be 80,000 JPY.

However, with a NISA, the entire 100,000 JPY will be received by the individual.

There are currently three kinds of NISA accounts under the existing system: the (1) regular NISA, the (2) Tsumitate (accumulation) NISA, and the (3) Junior NISA. Below is a comparison of these three kinds of NISA.

Current NISA Program

| Regular NISA | Tsumitate NISA | Junior NISA | |

|---|---|---|---|

| Who Can Open | Any Japanese resident who is 20 years old and above (as of January 1st of the year account is opened) *1 | Any Japanese resident who is 20 years old and above (as of January 1st of the year account is opened) *1 | Any Japanese resident who is 0 to 19 years old (as of January 1st of the year account is opened) |

| Tax-exempt Transactions | Dividends, distributions, and gains on transfer from investments in stocks and mutual funds | Dividend and transfer gain from investment in certain mutual funds | Dividends, distributions, and gains on transfer from investments in stocks and mutual funds |

| Maximum amount of tax-exempt annual investments | Up to 1.2 million yen new accounts (maximum of 6 million yen) | Up to 400,000 yen for new accounts (maximum of 8 million yen) | Up to 800,000 yen for new accounts (maximum of 4 million yen) |

| Tax-exempt Period | Maximum of 5 years (*2) | Maximum of 20 years | Maximum of 5 years (*2) |

| Investment Period | 2014 to 2023 | 2018 to 2037 | 2016 to 2023 |

| Unique Qualities | Investment products are limited to certain investment trusts suitable for long-term funding and diversification | Funds cannot be withdrawn until the account owner is 18 years old |

*1 One can open either a Regular NISA or a Tsumitate NISA

*2 Once the non-taxable period lapses, one can open a new NISA account and roll-over their investments to the new account

A Review of the NISA System

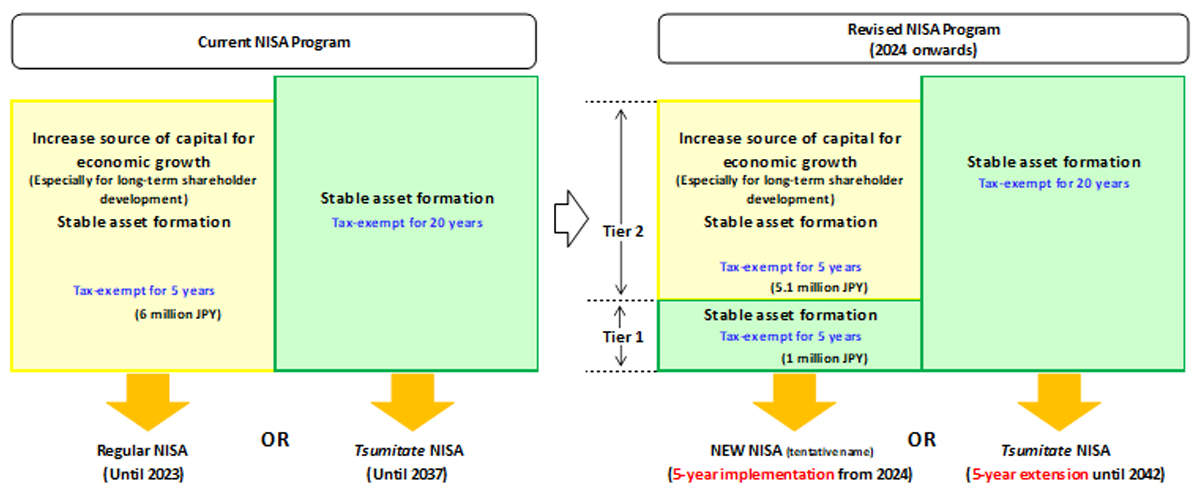

According to the Outline, the following changes regarding the “extension of the account opening period of NISA accounts while revising the program so that it may further promote small-scale regular and diversified investments” was from the perspective of “supporting stable asset formation for hundred-year households” while “increasing the supply of capital necessary for economic growth”.

Changes to the NISA Program

| Regular NISA | From 2024, together with the introduction of a new 2-tier program (tentatively named the “New NISA”), the period for opening of Regular NISA accounts will be extended for another 5 years (until 2028). The first tier in the New NISA program will be similar to the Tsumitate NISA, while the second tier will exclude investment products that are not suitable for stable asset formation, such as high-leverage hedge funds, that are included in the current NISA program. |

|---|---|

| Tsumitate NISA | Period for opening accounts has been extended by 5 years (until 2042) |

| Junior NISA | Period for opening accounts remains unchanged (until 2023, as scheduled) |

A major point in the revision of the NISA program is the Regular NISA’s transformation into the tentatively-named “New NISA” and the new investment restrictions applied to the New NISA’s two-tier program. With accounts under the Junior NISA program expiring by the end of 2023, the NISA program will be revised into a two-type program made-up of the “New NISA” and the “Tsumitate NISA”. An illustration of the changes of to NISA program can be found below.

Changes to the NISA Program

| New NISA (tentative name) (5 years from 2024) | Tsumitate NISA (5-year extension) | |

|---|---|---|

| Annual Investment Limit | Tier 2: 1.2 million JPY Tier 1: 200,000 JPY * In order to encourage more people to experience accumulating funded and diversified investments, account holders would generally be required to first open accounts on the first tier of the New NISA before they are allowed to enjoy the tax-exempt limits on the second tier. * An example of an exception to the above rule: From the perspective of stimulating the supply of capital necessary for economic growth (especially for long-term shareholder growth), if an investor or person who has opened a NISA account only invests in listed stocks on the second tier, there is no need to open an account on the first tier. | 400,000 JPY |

| Tax-exempt period | Tier 2: 5 years Tier 1: 5 years (at the end of the 5 years, Tier 1 accounts may be converted into Tsumitate NISA) | 20 years |

| Account Opening Period | Will change from until 2023 to until 2028 (5-year implementation) | Will change from until 2037 to until 2042 (5-year extension) |

| Tax-exempt products | Tier 2: Listed shares, equity unit investment trusts, etc. (see note) Tier 1: Similar to the Tsumitate NISA (Certain equity unit investment trusts suitable for funded and diversified investments) | Certain equity unit investment trusts suitable for funded and diversified investments |

(Remarks) As specified by the law, the Junior NISA program will end as scheduled at the end of 2023 without any extension.

(Note) Excludes leveraged investment trusts and delisted stocks and securities under supervision.

Reference: (Financial Services Agency) Key Highlights of the 2020 (Reiwa 2) Tax Reforms

https://www.fsa.go.jp/news/r1/sonota/zeikaitaiko01.pdf

Conclusion

Among the individual income tax reforms highlighted in the Outline of the FY 2020 Tax Reform gaining attention is the review of the NISA program.

Cash and deposits account for a significantly higher percentage of a household’s wealth composition in Japan compared to other Western countries. In other words, the liquidity of assets is low in Japan because cash and cash equivalents for the majority of financial assets, and the circular flow of money from households to businesses through the market is weaker compared to Europe and the United States. From the introduction of the NISA program, to the review and expansion of the program, Japan aims to stimulate economic revitalization by directing cash and deposit assets to investment assets, and to stabilize household funds through funded and diversified investments. On the other hand, many say that the NISA program is difficult to understand, and the introduction of the “New NISA” will further complicate the situation ― it will take some time for investment assets to take root in households, starting with letting the public understand the program. We hope that you can use this article as a reference for understanding the system and it has helped you become more aware of the upcoming tax reforms.